what is a good net debt to ebitda ratio

What is the Internet Debt to EBITDA Ratio?

The net debt to earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio measuresfinancial leverage and a company's ability to pay off its debt . Essentially, the net debt to EBITDA ratio (debt/EBITDA) gives an indication as to how long a company would need to operate at its current level to pay off all its debt. The ratio is commonly used by credit rating agencies to determine the probability of a company defaulting on its debt.

Formula

The Debt to EBITDA ratio formula is every bit follows:

Where:

- Net debt is calculated as short-term debt + long-term debt – cash and cash equivalents.

- EBITDA stands for earnings before interest, taxes, depreciation, and acquittal.

Practical Example of EBITDA Ratio

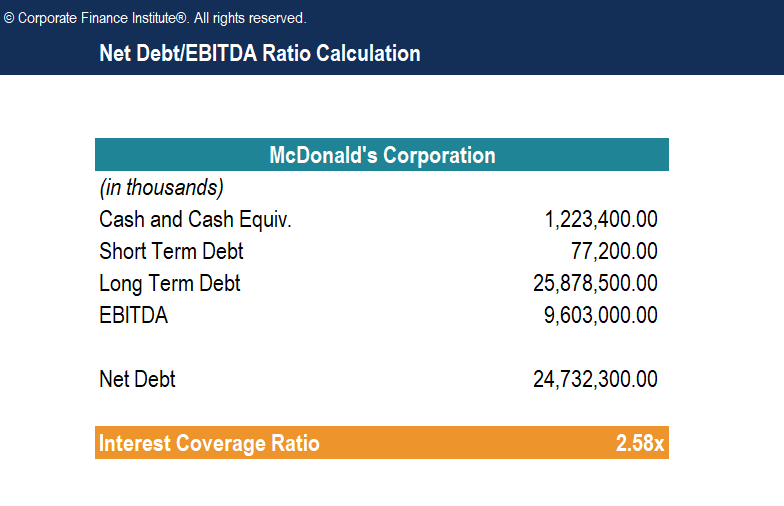

For example, McDonald'southward Corporation reported the following figures for the financial yr catastrophe December 31, 2016:

The Debt to EBITDA for McDonald's is calculated as follows:

Download the Free Template

Enter your proper noun and email in the grade beneath and download the free net deb to EBITDA ratio template now!

Net Debt/EBITDA Ratio Template

Download the free Excel template now to advance your finance knowledge!

Interpretation

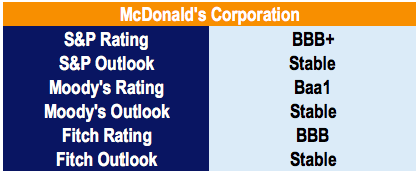

A low net debt to EBITDA ratio is mostly preferred past analysts, as it indicates that a visitor is not excessively indebted and should be able to repay its debt obligations. Conversely, if the internet debt to EBITDA ratio is high, it indicates that a visitor is heavily burdened with debt. That situation would lower the company'due south credit rating and investors would, therefore, require college yields on bonds to recoup for the higher default risk. For McDonald'due south Corporation, Standard & Poor's (South&P) assigned a credit rating of BBB+, Moody's assigned a credit rating of Baa1, and Fitch assigned a credit rating of BBB:

Source: Information compiled on Capital IQ in 2018.

Generally, a net debt to EBITDA ratio in a higher place 4 or five is considered high and is seen every bit a ruby flag that causes business for rating agencies, investors, creditors, and analysts. However, the ratio varies significantly between industries, equally each industry differs profoundly in upper-case letter requirements. Every bit a result, information technology is all-time used to compare companies in the same industry. In a loan agreement betwixt a visitor and a lender, the lender often requires the visitor to remain below a certain net debt to EBITDA ratio.

Key Takeaways

- The net debt to EBITDA ratio measures a company'south power to pay off debt with EBITDA .

- The ratio is normally used by credit rating agencies to assign a credit rating to a company.

- A low ratio is preferred and indicates that the company is non excessively indebted.

- A high ratio indicates that the company has high debt levels, and may, consequently, upshot in a lower credit rating (therefore mandating the company offer college yields on bonds).

- An ideal debt to EBITDA ratio depends heavily on the industry, as industries vary greatly in terms of average majuscule requirements. Nonetheless, a ratio of greater than 5 is usually a cause for business.

- To ensure that a company is able to repay debt obligations, loan agreements typically specify covenants that dictate the range which a company's net debt/EBITDA ratio tin autumn nether.

Related Readings

Thank you for reading CFI's explanation of the net debt to EBITDA ratio. CFI offers the Financial Modeling & Valuation Analyst (FMVA)™ certification program and other training for fiscal professionals. To learn more and aggrandize your career, explore the boosted relevant CFI resources below.

- Leverage Ratios

- Debt Covenants

- Analysis of Financial Statements

- Financial Modeling Guide

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/net-debt-ebitda-ratio/

0 Response to "what is a good net debt to ebitda ratio"

Post a Comment